The Best Strategy To Use For Broker Mortgage Calculator

Wiki Article

Broker Mortgage Fees Can Be Fun For Anyone

Table of ContentsExcitement About Broker Mortgage RatesAll about Mortgage Broker Assistant Job DescriptionThe Main Principles Of Mortgage Broker Some Ideas on Mortgage Broker Average Salary You Should KnowThe Ultimate Guide To Mortgage Broker Vs Loan OfficerTop Guidelines Of Broker Mortgage Meaning

The mortgage broker's job is to comprehend what you're attempting to attain, function out whether you are prepared to jump in now and after that match a lending institution to that. Prior to chatting concerning lending institutions, they need to gather all the information from you that a financial institution will certainly require.

A major change to the sector happening this year is that Home loan Brokers will need to comply with "Benefits Duty" which suggests that lawfully they have to place the client initially. Remarkably, the banks do not need to abide by this brand-new policy which will certainly benefit those customers using a Mortgage Broker much more.

How Broker Mortgage Calculator can Save You Time, Stress, and Money.

It's a home loan broker's work to aid get you ready. Maybe that your savings aren't quite yet where they ought to be, or maybe that your earnings is a bit suspicious or you have actually been self-employed and the banks require even more time to assess your situation. If you're not yet ready, a mortgage broker is there to furnish you with the knowledge as well as advice on how to improve your position for a loan.

The residence is yours. Composed in cooperation with Madeleine Mc, Donald - Mortgage broker.

Examine This Report on Broker Mortgage Meaning

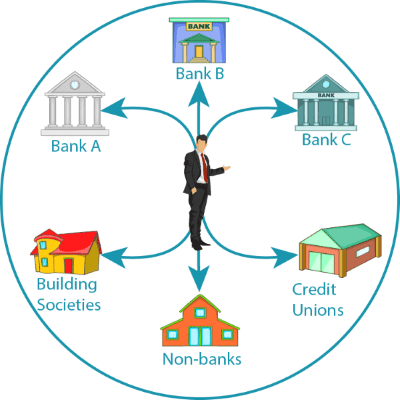

They do this by comparing mortgage products offered by a range of lending institutions. A mortgage broker works as the quarterback for your financing, passing the sphere in between you, the debtor, as well as the lender. To be clear, home mortgage brokers do much even more than help you get a simple mortgage on your residence.When you most likely to the financial institution, the financial institution can only provide you the products as well as services it has available. A financial institution isn't likely to inform you to decrease the road to its rival who uses a home loan item much better matched to your demands. Unlike a financial institution, a home mortgage broker often has partnerships with (usually some loan providers that do not directly deal with the general public), making his possibilities that a lot better of locating a lending institution with the very best mortgage for you.

If you're wanting to re-finance, gain access to equity, or get a bank loan, they will certainly need info regarding your existing lendings already in location. Once your mortgage broker has a great suggestion mortgage broker licenses about what you're trying to find, he can develop in on the. In a lot of cases, your home mortgage broker might have nearly everything he needs to wage a mortgage application at this factor.

Everything about Mortgage Broker Association

If you have actually already made an offer on a home as well as it's been approved, your broker will send your application as a real-time bargain. Once the broker has a home loan dedication back from the loan provider, he'll look at any problems that require to be met (an evaluation, proof of revenue, evidence of deposit, and so on).This, in a nutshell, is exactly how a home loan application functions. Why utilize a home mortgage broker You might be wondering why you ought to utilize a home mortgage broker.

Your broker ought to be well-versed in the home loan items of all these lending institutions. This suggests you're more probable to find the most effective home mortgage product that matches your demands. If you're a specific with damaged debt or you're buying a home that's in less than outstanding problem, this is where a broker can be worth their king's ransom.

9 Easy Facts About Mortgage Broker Association Explained

When you go shopping by yourself for a home mortgage, you'll need to look for a home loan at each lender. A broker, on the various other hand, must recognize the lenders like the back of their hand as well as should be able to focus in on the lending institution that's ideal for you, conserving you time and securing your credit report from being decreased by applying at a lot of lending institutions.Be certain to ask your broker just how lots of loan providers he handles, as some brokers have accessibility to even more loan providers than others and also might do a greater quantity of service than others, which suggests you'll likely obtain a better price. This was an overview of collaborating with a mortgage broker.

85%Promoted Rate (p. a.)2. 21%Comparison Price (p. a.) Base standards of: a $400,000 lending quantity, variable, repaired, principal as well as rate of interest (P&I) home mortgage with an LVR (loan-to-value) ratio of a minimum of 80%. The 'Contrast Home Loans' table allows for estimations to made on variables as chosen mortgage brokerage as well article source as input by the individual.

The Ultimate Guide To Mortgage Broker Association

The option to making use of a home loan broker is for individuals to do it themselves, which is sometimes described as going 'straight'. A 2018 ASIC survey of consumers who had actually gotten a lending in the previous twelve month reported that 56% went straight with a loan provider while 44% experienced a home loan broker.Report this wiki page